European plastics manufacturers are shutting down facilities due to a sharp drop in production, driven by intense competition from an oversupply of low-cost materials globally. According to Plastics Europe, the industry’s trade body, European plastic production fell by 8.3% in 2023. Moreover, mechanical plastics recycling—the most common recycling method in Europe—also declined for the first time since 2018 due to reduced demand.

The downturn was more severe than anticipated, said Virginia Janssens, managing director of Plastics Europe. She highlighted concerns over “deindustrialisation in Europe,” which could increase reliance on “less sustainable imports.” Germany, the largest plastics producer in Europe, is particularly affected.

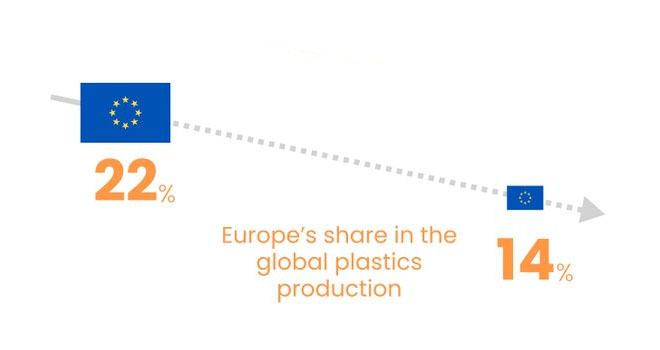

While Europe’s plastic production shrank, global output grew by 3.4% as countries like China and the US ramped up production. In 2023, China accounted for 60% of new petrochemical capacity globally, according to S&P Global. Europe’s share of the global plastics market has dwindled from 28% in 2006 to just 12% last year.

Regulations and Costs Undermine Competitiveness

Ambitious climate policies enacted during the previous European Commission term have led to stringent regulations that many companies blame for stifling growth. Former European Central Bank president Mario Draghi, in a September report on EU competitiveness, pointed to high energy costs, restrictive regulations, and cheaper overseas production as key factors in Europe’s economic slowdown.

The oversupply of virgin plastic outside Europe has also weakened the business case for recycled materials. Plastics Recyclers Europe warned last month that the declining European recycling market is pushing many recyclers out of business.