Yes, the cost of designing injection molds can generally be considered a deductible business expense. For businesses, expenses related to the production of goods, including the design and creation of molds, are often categorized as necessary and ordinary costs of doing business.

These costs can be deducted as part of the cost of goods sold (COGS) if they are directly tied to the manufacturing process. Alternatively, they may be capitalized and depreciated over time if the mold design represents a long-term asset.

However, tax laws can vary depending on the jurisdiction, and specific circumstances may affect the deductibility. It’s advisable to consult with a tax professional or accountant to ensure proper classification and deduction of these expenses according to applicable tax regulations.

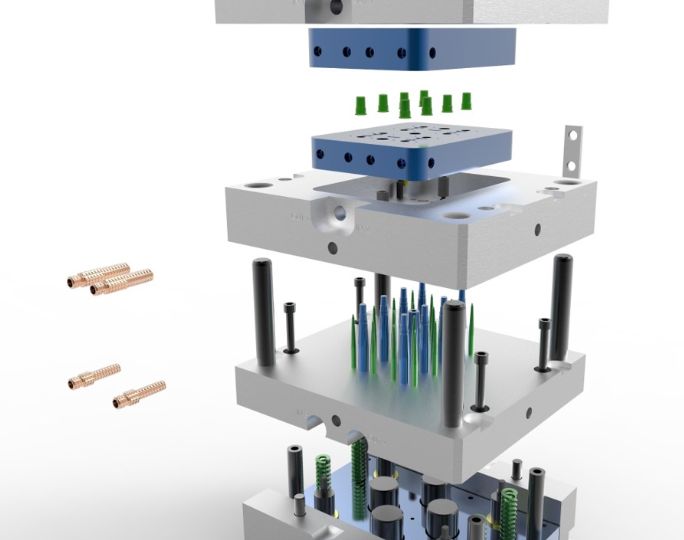

Related Conten: Mold Design

[elementor-template id=”4330″]

DTG Mould Trade Process |

|

| Quote: | According to sample, drawing and specific requirement. |

|---|---|

| Discussion | Mold material, cavity number, price, runner, payment, etc. |

| S/C Signature | Approval for all the items. |

| Advance | Pay 50% by T/T |

| Product Design Checking | We check the product design. If some position is not perfect, or can not be done on the mould, we will send customer the report. |

| Mold Processing | Send report to customer once each week |

| Mold Testing | Send trial samples and try-out report to customer for confirmation |

| Mold Modification | According to customer’s feedback. |

| Balance Settlement | 50% by T/T after the customer approved the trial sample and mould quality. |

| Delivery | Delivery by sea or air. The forwarder can be designated by your side. |

|

|